Web Content Viewer

Web Content Viewer

This site is intended for use by financial professionals only. Are you a financial professional?

ASSET-BASED LTC

As your clients look ahead to retirement, plans frequently center on family. The love between family members is a strong, enduring bond — the type of commitment that inspires us to put our loved ones first.

Today, many older Americans worry they’ll one day become a financial or emotional burden to the people they love most. If a client experiences a health event and requires long-term care (LTC) -- and they have not prepared for this need -- their family members could very likely become caregivers.

Digital resources at your fingertips

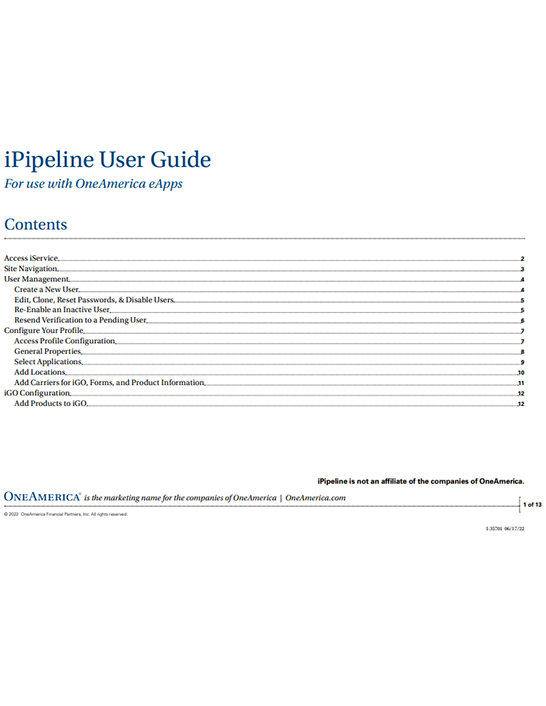

The features and deep-dive resources available here are built to improve your virtual workspace experience as you continue to grow your business.

What is Long-Term Care Insurance?

LTC insurance is a way to reimburse clients for covered expenses they may need with care at home or in a facility when they are unable to do some of these basic daily activities of daily living (ADLs): bathing, dressing, eating, continence, toileting and transferring.

Asset-based LTC products are about helping clients be prepared and provide protections clients won’t get from other options.. That way, if care is needed, they can pay for those services or care so loved ones don’t have to provide the care or change their lifestyle to provide care.

Help Tell the Story

For decades, Americans have relied on OneAmerica® Care Solutions asset-based long-term care products as they prepare for the future.

Now, we’ve refreshed our Care Solutions marketing materials. With an attractive look and clear, consumer-friendly language, these resources help convey our products’ tremendous value.

We have new materials for both producers and consumers.

The new, consumer-facing marketing materials are available in three categories: core brochures, funding option brochures and deep dives.

Care Solutions Core brochures

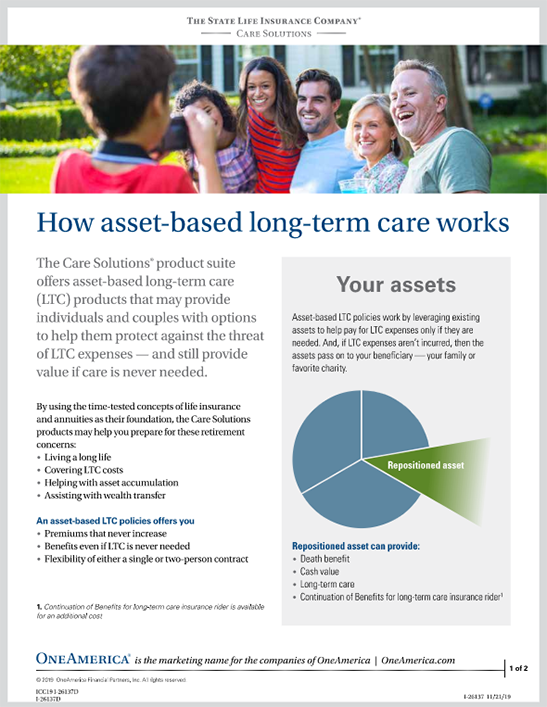

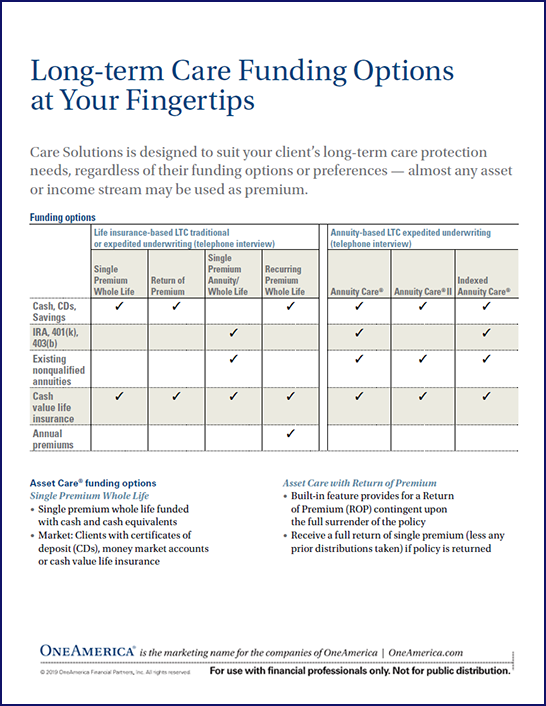

Our asset-based long-term care products use either life insurance or fixed-interest deferred or immediate annuities. The core brochures describe two types of Care Solutions products: life insurance-based and annuity-based.

Each core brochure provides a high-level overview of the product concept, describes how each product works and details realistic examples to help explain certain features and other Care Solutions benefits.

Funding option brochures

With each product type, you have multiple ways to fund your coverage. To help you understand your choices, these brochures go into a deeper level of information than the core brochures. The content covers product highlights, hypothetical examples, benefit triggers and protection-enhancing policy riders.

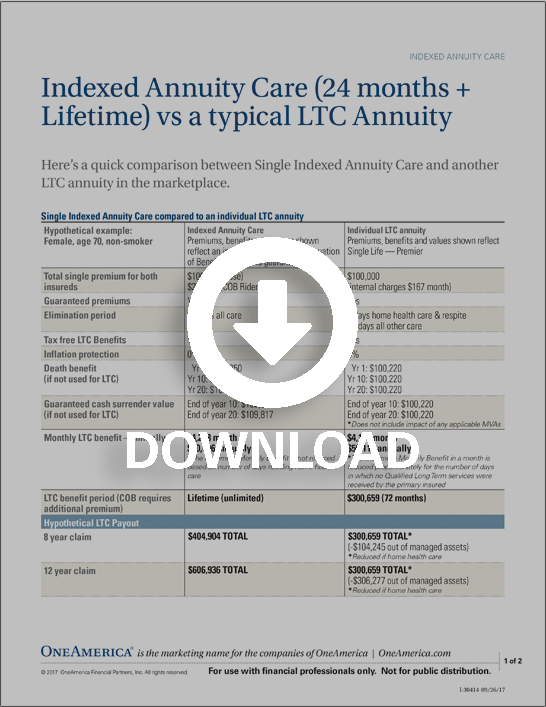

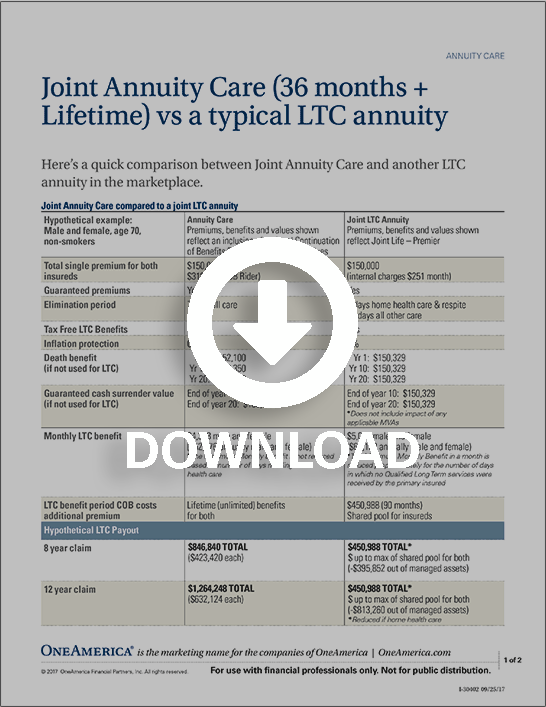

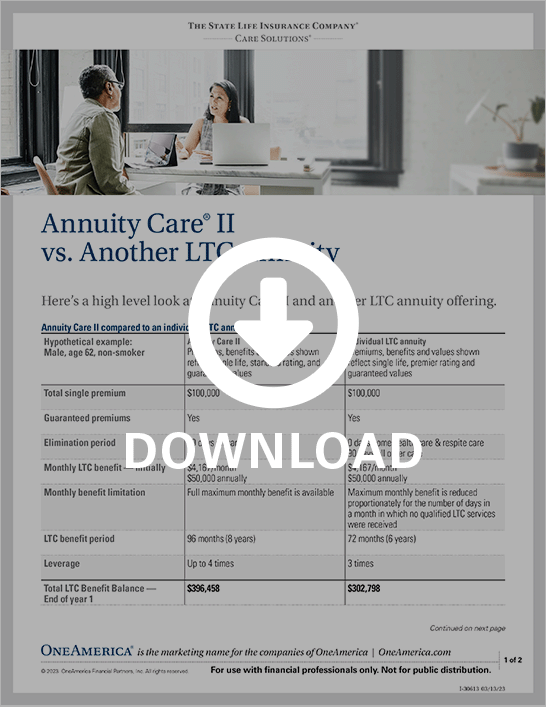

Deep dives

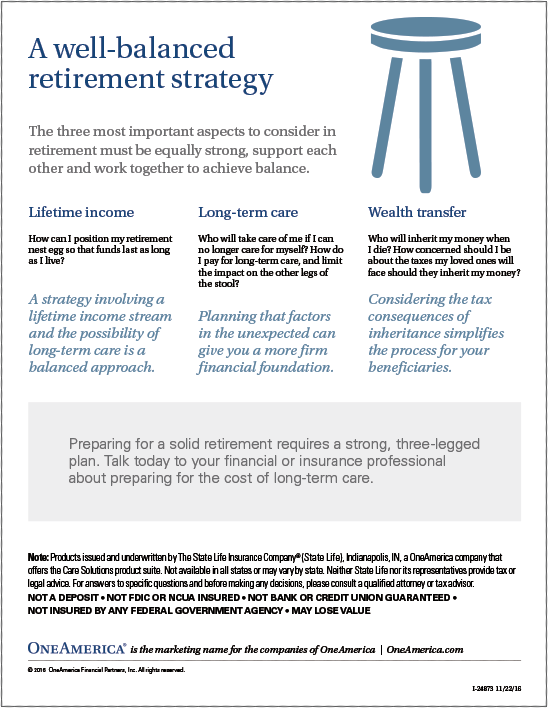

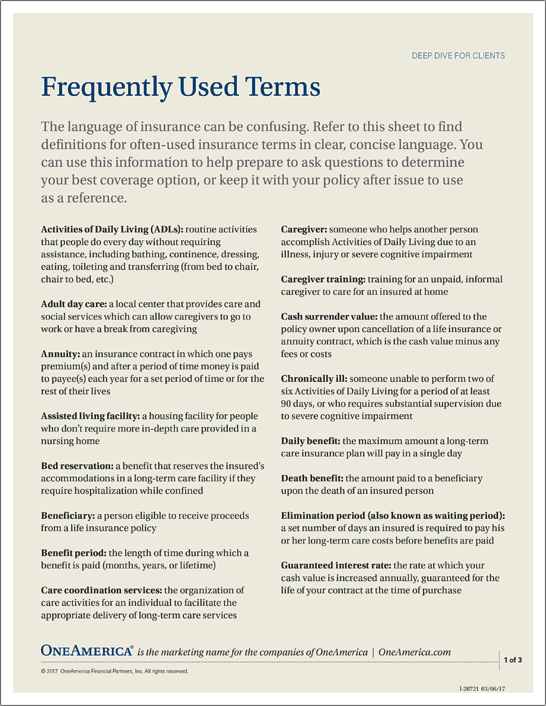

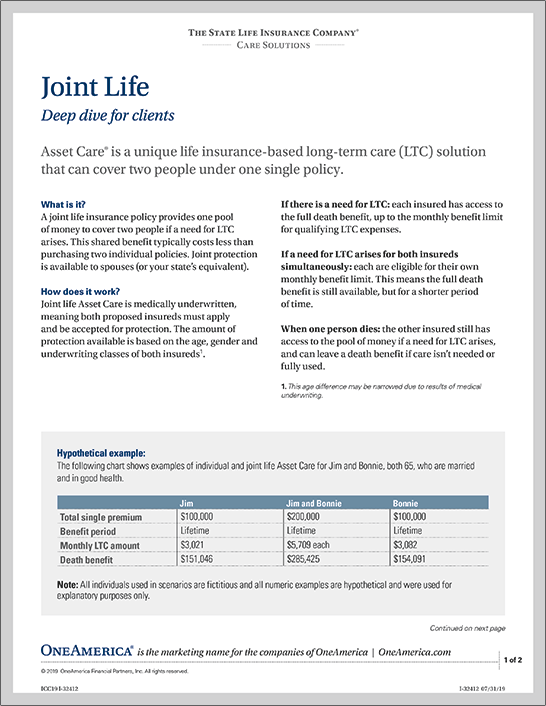

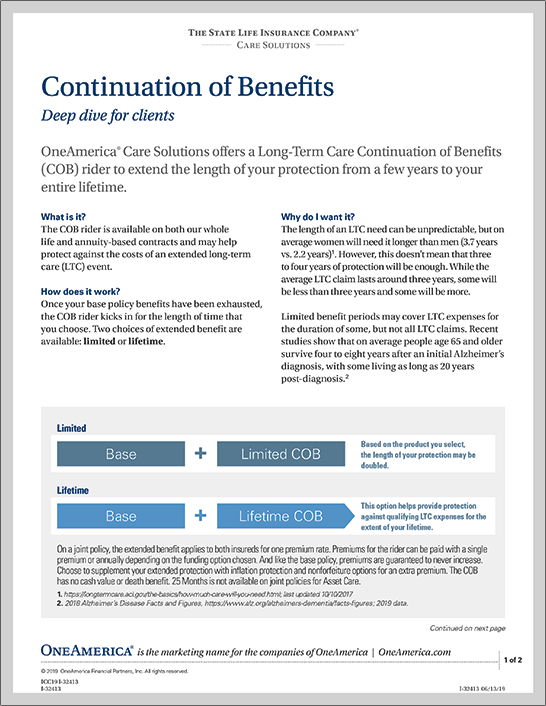

These helpful sheets take a more in-depth look — a “deeper dive” — into product specifics. Educational topics include joint coverage, insurance definitions and more.

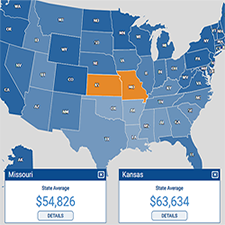

State-specific sales materials

If you don't find materials for your state listed below, contact the OneAmerica Sales Desk at 1-844-833-5520 or your back office for support.

Reference Materials

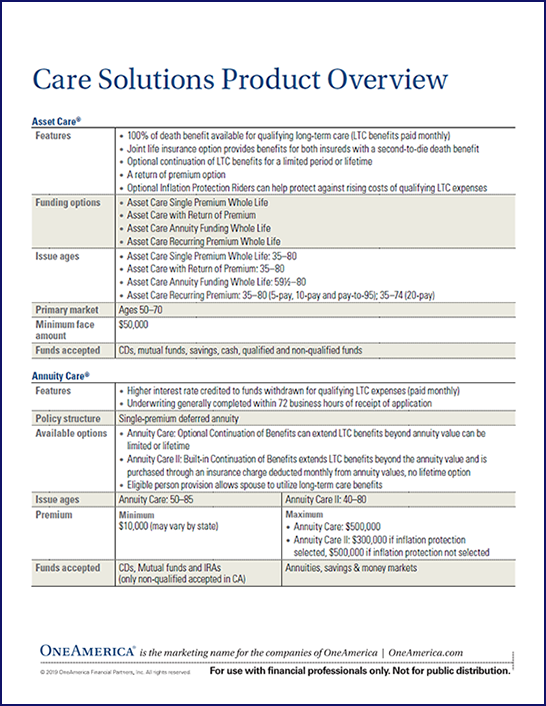

Now answers to your product and process questions are at your fingertips! Consult the Care Solutions® Product Guide for details about our products and funding options. The Process Guide combines the New Business and Underwriting guides into one handy reference to submitting Care Solutions business.

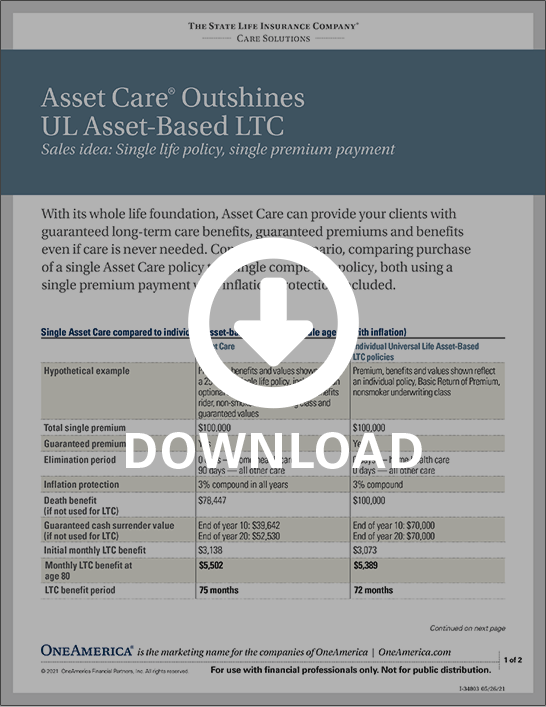

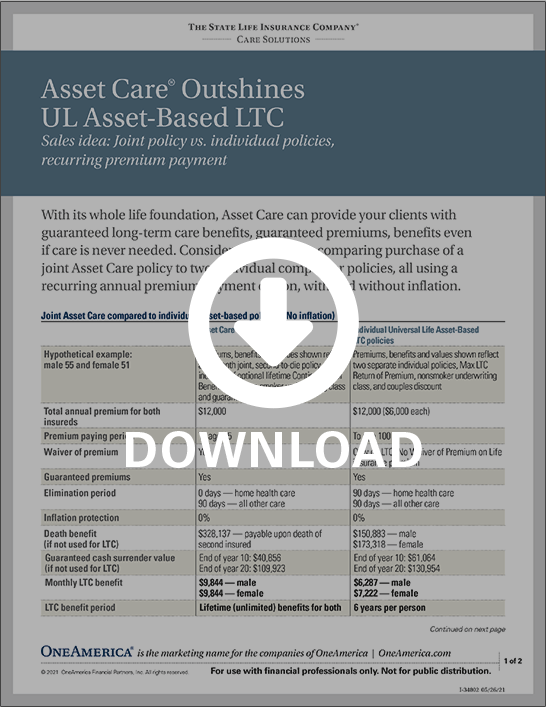

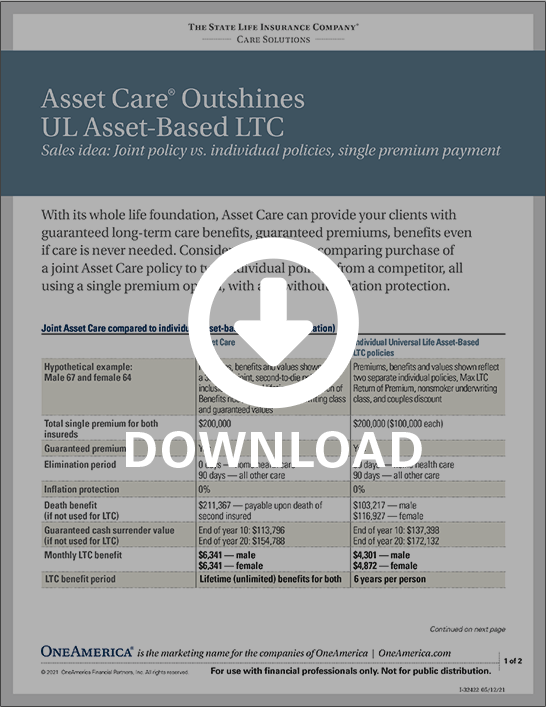

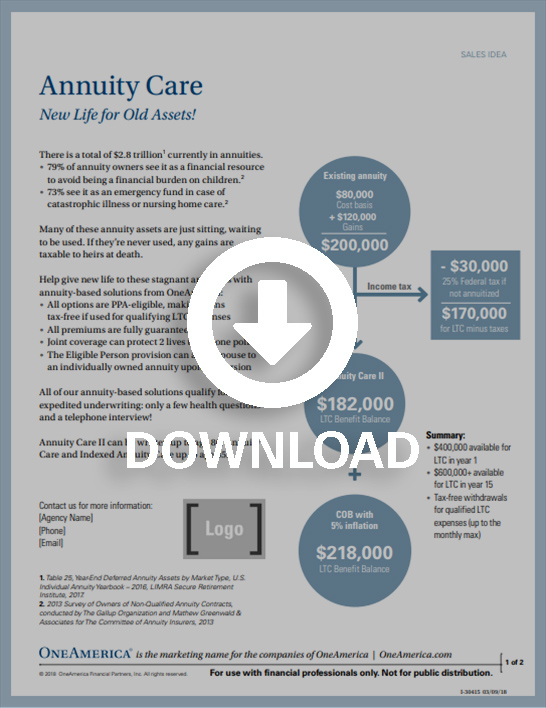

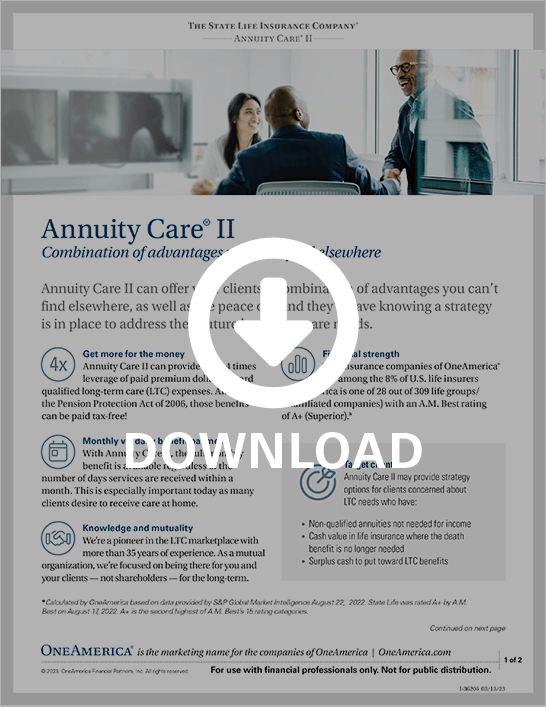

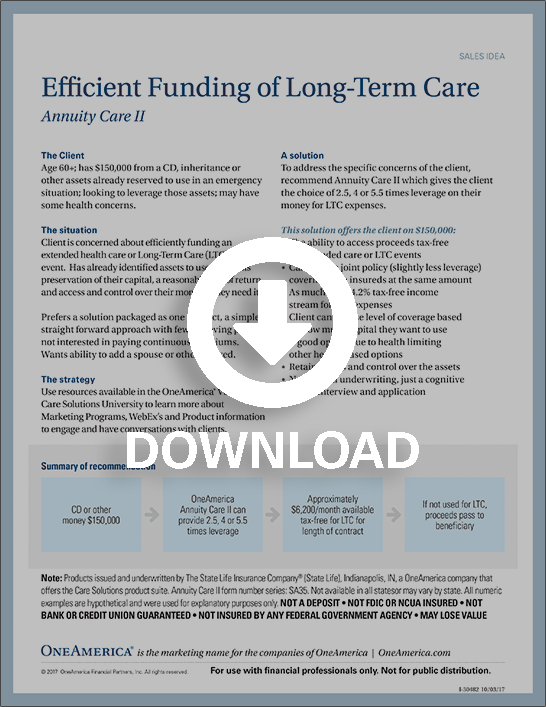

Sales Ideas

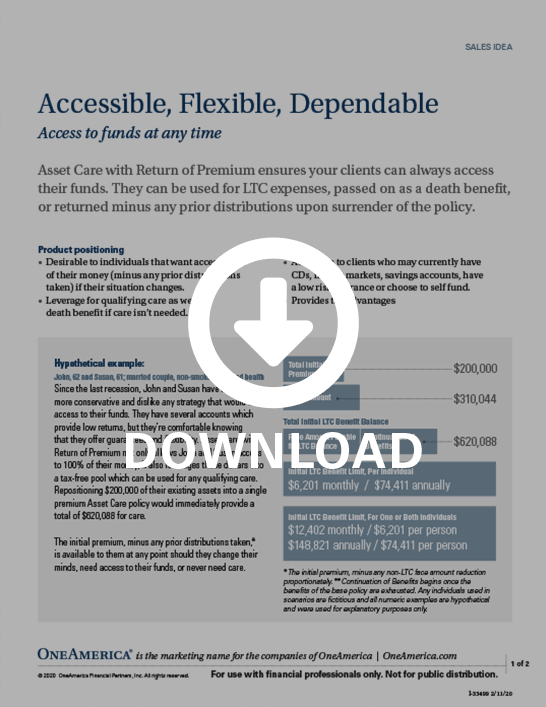

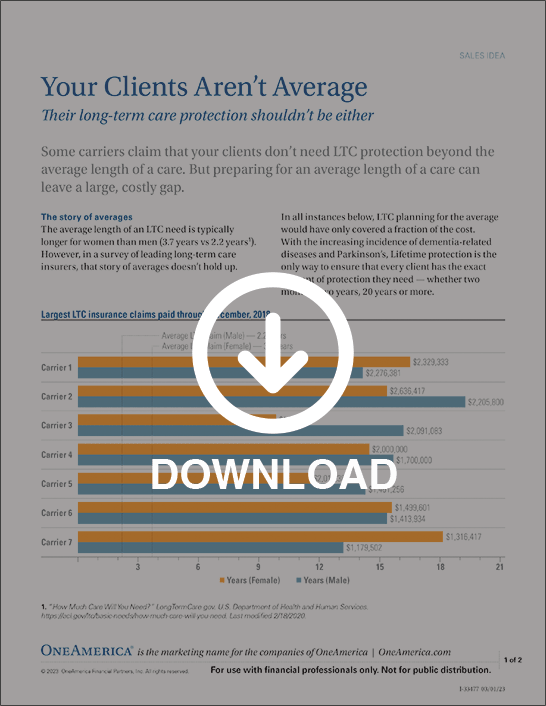

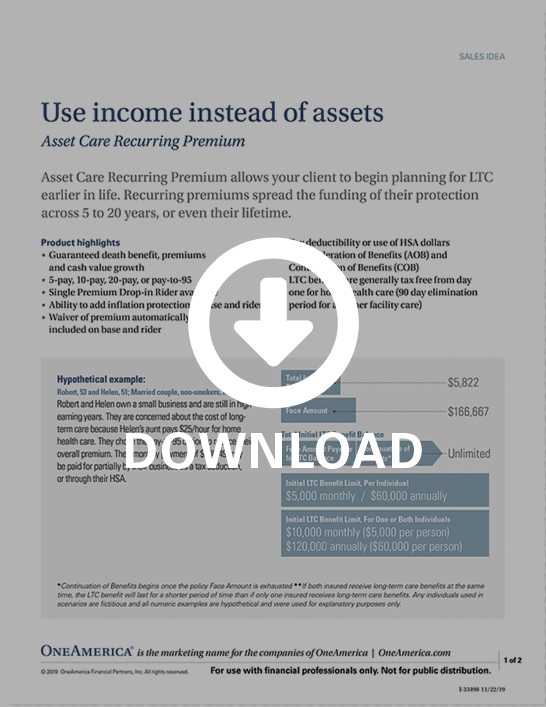

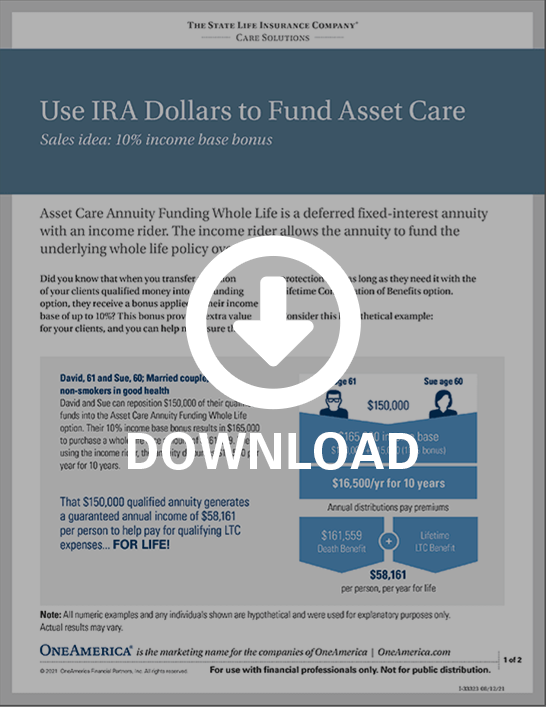

The new, producer-facing sales ideas can help you understand the value provided by our long-term care solutions. These pieces help explain best practices to communicate specific aspects of our products. Be sure to check back often, as we’re constantly creating new materials to use.

Not a deposit • Not FDIC or NCUA insured • Not bank or credit union guaranteed • Not insured by any federal government agency • May lose value

OneAmerica® is the marketing name for the companies of OneAmerica.

Note: Products are issued and underwritten by The State Life Insurance Company® (State Life), Indianapolis, IN, a OneAmerica company that offers the Care Solutions product suite. Asset Care Form number series: ICC18 L302 SP, ICC18 L302 SP JT, ICC18 R537, ICC18 R538, ICC18 R532, and ICC18 R533; Annuity Care and Annuity Care II form numbers: SA34, R508; SA35; Indexed Annuity Care form numbers: SA36, R529 PPA, R529, R530 PPA and R530. Not available in all states or may vary by state. All guarantees are subject to the claims-paying ability of State Life.

For use with financial professionals only. Not for public distribution.

Provided content is for overview and informational purposes only and is not intended as tax, legal, fiduciary, or investment advice.

PM-834