Have a question? Like more information?

Web Content Viewer

Web Content Viewer

Fiduciary basics

Fiduciary basics

Fiduciary basics

Offering a retirement plan is a rewarding benefit to participating employees, their beneficiaries and plan sponsors. Yet with that benefit come the important fiduciary responsibilities of administering the plan and managing its assets.

The word “fiduciary” derives from the Latin word for trust. Basic fiduciary responsibilities include:

- Acting prudently and in the best interest of others

- Disclosing adverse information to beneficiaries

- Receiving no more than reasonable compensation

The Employee Retirement Income Security Act of 1974 (ERISA) imposes additional, specific rules that fiduciaries must follow to protect the rights of consumers. The Department of Labor’s (DOL) new Conflict of Interest Rule, also known as the fiduciary rule, expands the scope of those rules and responsibilities, especially in the context of qualified retirement plans. (See The fiduciary rule below.)

Types of ERISA fiduciaries

Each plan may involve different types of fiduciaries with varying degrees of fiduciary responsibility. A plan sponsor, plan administrator, plan trustee, investment manager or committee member may all act as fiduciaries. Here’s a brief overview of the types of ERISA fiduciaries and their roles and responsibilities:

402(a) named fiduciary

Section 402(a) of ERISA mandates that each employee benefit plan designate, in writing, a fiduciary that has authority to control the management or administration of the plan. This named fiduciary functions as the plan’s CEO and, by definition, is often the most important fiduciary associated with a plan. The named fiduciary is listed in the plan documents and allows participants to identify with the person or people who have control over the plan.

3(21) limited scope fiduciary

A limited scope 3(21) fiduciary (namely advisors appointed to the plan) provides guidance with regards to plan investments to the plan sponsor or trustee. The ultimate responsibility for investment related decisions still rests with the plan sponsor. A 3(21) fiduciary may:

- Provide recommendations regarding the investment lineup

- Monitor those investments and suggest replacements, as appropriate

- Educate participants on with regards to the plan’s options

- Assist the plan sponsor on establishing investment policies for the plan; including the creation of a formal investment policy statement

3(38) fiduciary

Investment managers, insurance companies or banks may act as 3(38) fiduciaries. This type of fiduciary manages and directs changes to a plan’s investments in accordance with the investment policy statement and guidelines, and must acknowledge fiduciary status in writing. The plan sponsor is relieved of any investment related decisions made by the advisor. A 3(38) fiduciary focuses on plan-level activities including:

- Investment policy statements

- Initial selection of the investment lineup

- Ongoing investment monitoring and replacement

- Providing an audit trail of actions taken with regard to investments

- Quarterly communication with the retirement plan committee

- Documenting meeting outcomes

3(16) fiduciary

This is the person who has been designated as the plan’s administrator according to plan documents. If no specific individual is named, the responsibility falls to the plan sponsor. If the plan is maintained by two or more employers, then the association, board, trustees or other group of representatives become responsible for the maintenance of the plan. ERISA imposes very few specific obligations for a 3(16) fiduciary. Obligations primarily relate to reporting and disclosure, such as:

- Furnishing blackout notices

- Engaging a Certified Public Accountant

- Preparing and filing Form 5500

- Furnishing other participant disclosures and Summary Plan Documents

- Providing quarterly benefits statements

Learn more about your fiduciary responsibilities in this document.

The fiduciary rule

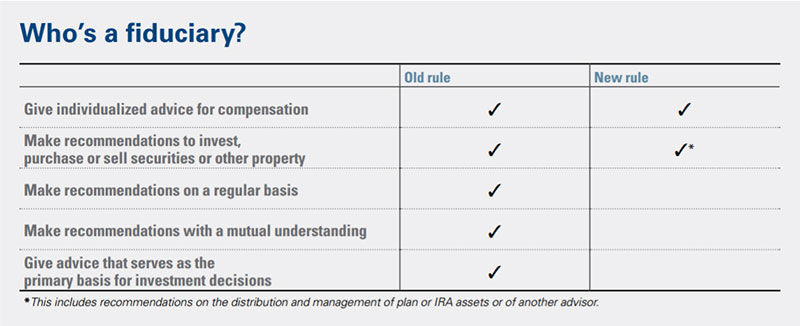

The new fiduciary rule introduces a host of changes in the retirement and financial services marketplace. It changes the definition of covered investment advice as well as who is considered a fiduciary. Under the new rule, anyone who makes recommendations in tax-qualified accounts and receives compensation in return will be considered a fiduciary. This is a significant change, as the chart below illustrates.

Under the new fiduciary rule, even receiving compensation for recommending another advisor will be a fiduciary act. Learn more at the Department of Labor’s Conflict of Interest Rule website.

The fiduciary rule also formalizes what it means to act in a customer’s best interest. To comply with the rule, fiduciaries must:

- Favor the customer’s interest over self-interest or that of a third party

- Carry out their duties prudently

- Use an applicable exemption before accepting payments that would create conflicts of interest

- Only accept reasonable compensation

Many people in our industry have been preparing for the implementation of the new fiduciary rule—including OneAmerica. Our efforts to move forward and comply have continued based on the rule’s existing timeline, despite the fact that examination of the rule has increased speculation about the rule’s future.

On April 7, 2017 the DOL announced a 60-day extension of the rule’s applicability date. As of now, the definition of a fiduciary, as published in the April 8, 2016 version of the rule, will go into effect on June 9, 2017. Full compliance with the new rule is expected on January 1, 2018. In light of this, we encourage plan sponsors and others affected by the rule to continue their preparations as planned.

Learn more about the fiduciary rule and its impact at the Department of Labor’s Conflict of Interest Rule website.

Questions? Contact our Retirement Services Internal Sales Desk at 1-866-313-7355.

NOTES: Provided content is for overview and informational purposes only and is not intended as tax, legal, fiduciary, or investment advice.

Web Content Viewer

Web Content Viewer

NOTES: Provided content is for overview and informational purposes only and is not intended as tax, legal, fiduciary, or investment advice.

Web Content Viewer

Web Content Viewer

Service Starts Here

Check in, Check up

Actively engage with your policies, plans and strategies.

Products & Services

Life insurance, long-term care benefits, retirement plans and more