Web Content Viewer

Web Content Viewer

Retirement Attitudes, Behaviors: OneAmerica Participant Survey

August 24, 2018 | Research

A national leader in the retirement industry, Indianapolis-based OneAmerica® helps customers build and protect their financial futures.

With roots that go back more than 140 years, we currently use a relationship-based service model to help participants optimize outcomes and pursue their goals. As a mutual organization, we serve customers on Main Street, not corporate shareholders on Wall Street. We are built for the benefit of those we serve; those who place their trust in us.

A critical component of that trust is providing plan sponsors and their advisors with insights into how they can better connect with participants and provide more effective communications to help drive positive retirement outcomes. We frequently seek feedback and solicit input, both in person and through virtual channels.

We’ve completed our third participant survey since 2014, which resulted in more responses than ever – over 12,200 participants completed all questions.

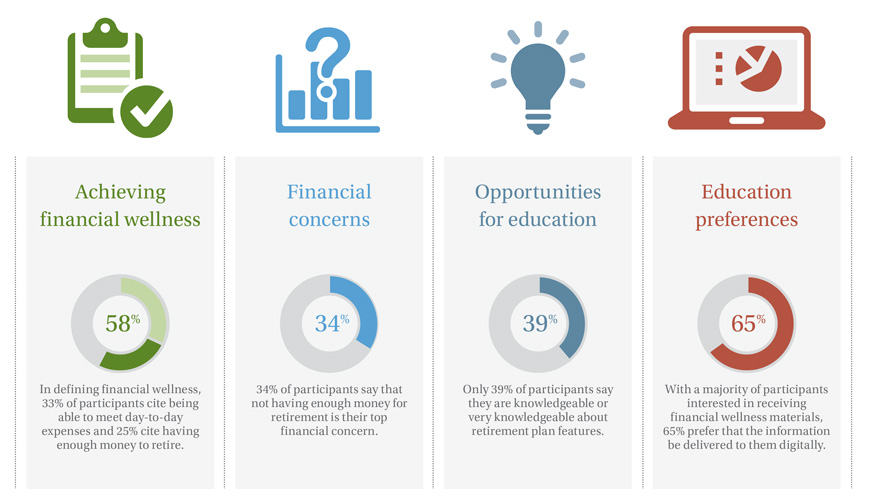

Participants responded to questions about their attitudes and behaviors toward financial wellness, retirement preparation and their knowledge level on various personal finance topics. Based on the survey findings, we provide suggestions for ways plan sponsors can better engage with their employees to help them become more retirement ready.

In our survey, participants provided feedback and information about:

- How financial wellness is defined

- Financial stress levels and financial concerns

- Important attributes in achieving financial wellness

- The impact student loans have on retirement preparation

- Health Savings Account usage

- Roadblocks to working with a financial professional

- Knowledge level about specific financial topics

- Interest in receiving financial wellness communications and preferred communication channels

We analyzed the survey results by looking at five subsets of respondents. Analyzing the survey results through these lenses enables us to understand how plan sponsors may better serve their participants in a variety of demographics. The following subgroups were analyzed:

- Gender: Male vs. female

- Age: Younger than 35, 35–49 and 50 and older

- Household Income: Low (< $50,000), Mid ($50,000-$99,999) and High ($100,000+)

- Retirement plan balance: Low (<$25,000), Mid ($25,000-$99,900) and High ($100,000+)

- Children in the household: Children in household vs. No children in household

Related Information

OneAmerica surveyed over 12,200 plan participants in 2017-18 to better understand participant trends and preferences. View our infographic and download our whitepaper.

OneAmerica produced the following news releases related to the survey:

Student Loans Have Significant Impact on Retirement Preparation

OneAmerica® participant poll illustrates how debt payback leads to a key investing roadblock

Survey Details Participant Financial Stress Levels, Concerns and Importance of Financial Wellness Education

OneAmerica® poll illustrates benefits of aiding participants so they achieve positive outcomes

Retirement Savers Report Roadblocks to Working with a Financial Advisor

Six of 10 participants don’t have one; OneAmerica® poll shows the gender gap is even worse

OneAmerica produced the following thought leadership piece for lifehealth.com:

Measuring Client Financial Knowledge

Participant poll reveals gaps in understanding of fundamentals, shifts in education preferences

NOTES: OneAmerica® is the marketing name for the companies of OneAmerica.